The Electrification Paradigm: Energy Trading & Low-Hanging Fruit

The shift towards electrification and variable renewable energy (VRE) is a paradigm adopted across the globe. Regardless of politics, war, and the impacts on market conditions, price volatility was always forecasted alongside the emergence of decentralised and decarbonised energy. And it’s only anticipated to steadily rise…

Image source: BCG – Why Your Company Needs to Be an Electricity Trader

It’s an interesting time to be an energy trader. The only consistency is volatility, which presents overwhelming opportunities for businesses. The “energy crisis” appears to be the catalyst for many businesses, large and small, to start taking note of how they can be more active participants in the energy markets, opposed to passive consumers.

Boston Consulting Group (BCG) recently released a series of articles that explore the changes to our electricity system. In the latest instalment “What CEOs can learn from Energy Traders?” they state:

“Large industrial energy users have traditionally procured electricity under long-term, low-cost, fixed-price contracts. This approach has enabled them to minimize costs and maximize utilization over decades. But in the future, as variable renewable energy (VRE) becomes the main form of power generation, these same large energy users will be exposed to increasingly volatile electricity prices. In this environment, companies will need to find new ways to create advantage and maximize profits from their energy-intensive operations.”

– BCG

Whilst irrefutably valid, this approach could be deemed exclusionary. Small and medium enterprises (SMEs) can, and should, be adjusting too, and there’s plenty of low-hanging fruit for these SMEs to acquire. Opportunities are not limited to those with hefty budgets.

The Electrification Paradigm: Energy Trading & Low-Hanging Fruit

One misconception is that using electricity flexibly is difficult, which can be the case when attempting to eat the proverbial elephant in its whole form. Larger businesses may find the cogs of policy, information exchange and contract more difficult to turn than the smaller, more agile organisations. However, there are steppingstones and ways to cut the said elephant into bite-sizes.

The first and easiest way to derive value from the electricity markets is through the use of on-site generation, such as solar panels, along with a battery system. Connect this to an intelligent energy management system (EMS), and you have the ability to charge and discharge at optimum times (essentially smart-charging) whilst selling stored or generated energy back to the grid at times of high prices. All within the parameters of uninterrupted operations. You can learn more about Wattstor’s technology here.

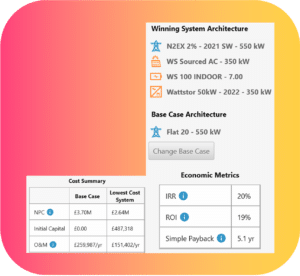

Below is a typical use case:

Typical site*

- Manufacturing, Devon, Southwest England

- 100-300kW typical load

- Typical day-driven load profile

- 20p/kWh standard flat electricity supply (much lower than current market)

* ~30,000 similar manufacturing sites in UK (>50 employees), source: ONS

Proposal**

- Add 350kW of Solar PV

- Add battery of 350kW/700kWh

- Change to Smart Fixed tariff

** Developed with HOMER, global leading microgrid software

O&M Cost include grid electricity supply cost

The Result

- 41% annual cost reduction

- ~£1.1M savings over lifetime of project (in present value)

- Average savings of £108,585 / year

- ~66 tons/year of customer CO2 emission reduction

- Battery + Solar PV has a better business case than just Solar PV

This is without even touching operational load shifting as a means to dodge peaks. This isn’t always possible due to operational constraints, however with a storage system there are many costs that can be mitigated and, depending on the operational assets (such as temperature controlled environments like refrigeration or furnaces), there may be the opportunity to create additional storage without a battery by front-loading the electricity usage.

“Companies that can be flexible about when they use electricity—by using less when it is expensive and more when it is cheap, free, or even negatively priced—will be able to significantly lower their energy costs.”

– BCG

The Trader mindset

The shift in energy landscape and markets needs to be met with a shift in mindset, and that mindset needs to move away from simple cost-driven efficiencies and towards optimised markets.

– Wattstor

- Regardless of the size of the business site, finding and creating energy flexibility should be prioritised over consumption reduction.

- Reactive sites will win the pricing game over those looking for certainty, and contracts should veer towards optionality over certainty.

- Overall operational profitability should be managed over and above productivity and traditional output.

- Intelligent information systems will prevail over simple cost-driven decisions.

That said, mindset only need apply to how a business chooses to approach energy – the skill-set and technology can and, in the case of smaller businesses, should be employed externally for both cost and resource efficiencies.

“The trader mindset of an asset-backed energy trader is very different to the producer mindset of most energy users.”

– BCG

It doesn’t have to be an all-or-nothing approach…

Where businesses cannot retrofit inflexible equipment, where the resource lacks to manage a full energy strategy overhaul, where expertise in energy markets is a proficiency stretch too far, and where budgets won’t tolerate too much uncertainty or grand scale installations; systems and partners exist to support. Because, again…

The opportunity to safely play and profit in energy markets is not a privilege reserved for those with brimming budgets.

– Wattstor

“Many companies have contractual or market arrangements which protect their business from volatility but, in doing so, prevent them from creating value from flexibility.”

– BCG

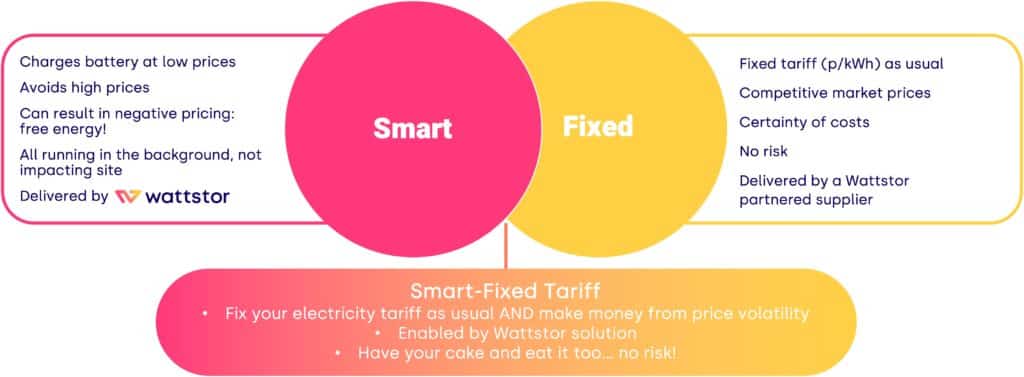

This is where smart-fixed tariffs shine…

Accessible for both large corporations and a particularly advantageous steppingstone for SMEs in the arena of energy trading, smart-fixed tariffs prepare a business for the emerging risks on the energy horizon.

You can learn more about smart-fixed tariffs in another of our blogs here.

So, how is your energy strategy shaping up for the future markets?

Interested to learn more about how businesses can mitigate their risks throughout the energy crisis? Register for our webinar Can SMEs smart-charge their way out of the energy crisis?