Energy prices in Germany are becoming increasingly unpredictable, with extreme intraday swings and frequent periods of negative pricing. For commercial and industrial (C&I) organisations, this volatility can quickly erode margins, disrupt planning, and undermine long-term energy security. The challenge is no longer about managing the occasional spike. Volatility is now a permanent fixture in the market.

Germany’s renewable generation is at a historic high. Over 60% of net public electricity supply came from renewables in 2024. Yet this success has introduced new market dynamics: periods of oversupply are triggering ‘renewables cannibalisation’, where weather-driven output drives prices down, sometimes below zero.

When renewable generation falls, during windless or dark hours, prices spike sharply as fossil generation and imports step in. Businesses with the ability to shift demand, store energy, and take advantage of dynamic tariffs stand to benefit most from this new reality.

READ: Wattstor Launches Price Protect in Germany

How much could you save with Wattstor?

Thanks to a strong push towards decarbonisation, 2024 was a record high for renewable generation in Germany. The total share of renewable net generation was around 58.6% in 2024, meaning electricity generation was lower in CO₂ emissions than ever before.

At the same time, as a global manufacturing powerhouse, energy resilience and price stability are a top priority for Germany’s economic growth. This is where the country is experiencing challenges.

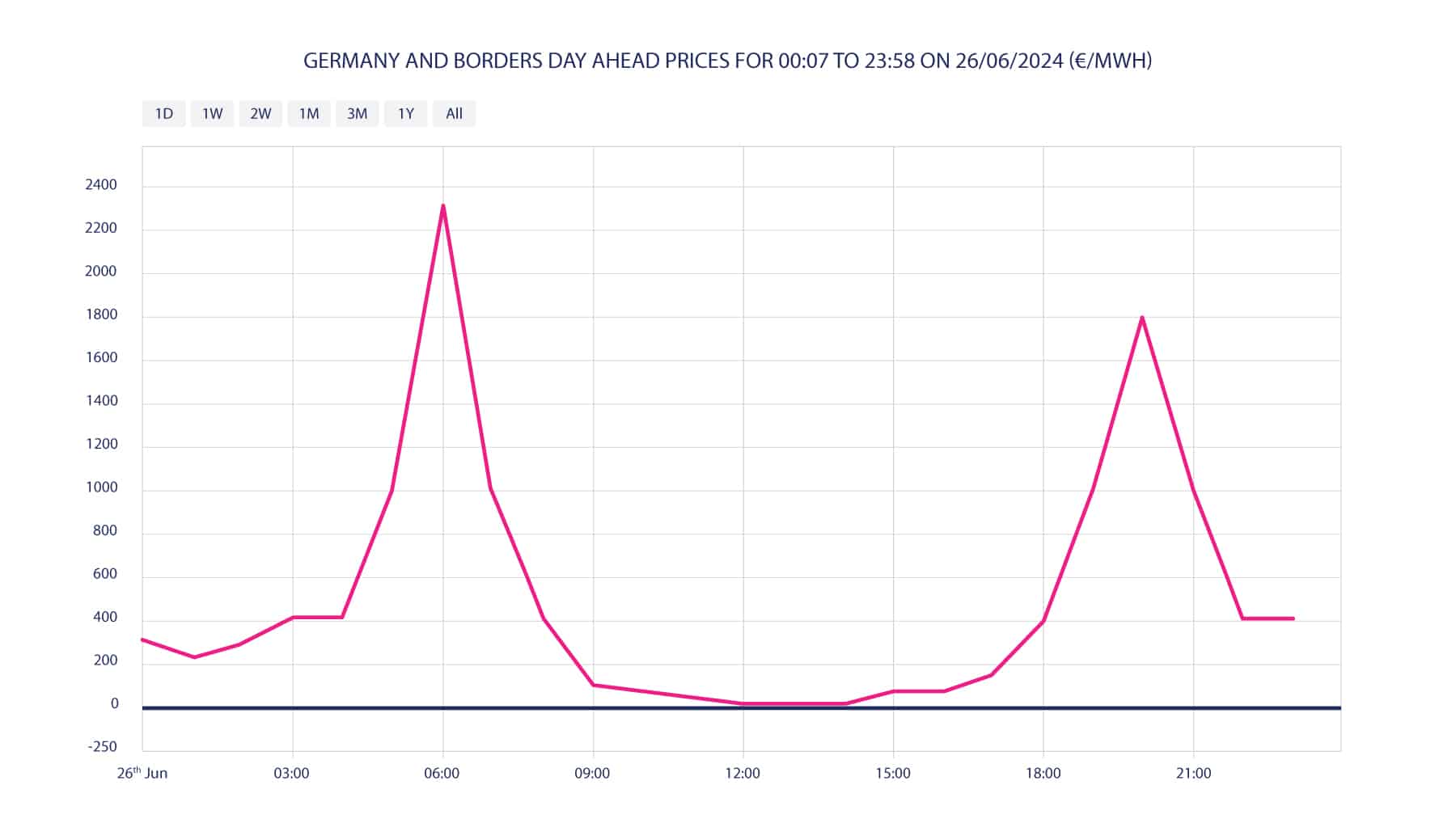

The graph below shows electricity price fluctuations on 26th June 2024. It’s easy to see that prices went from spiking at 6:00 am (€2,325.83/MWh), to negative at 12:00 pm (-€0.06/MWh). To put figures in context, let’s imagine the same thing happened to prices at a petrol station. A similar price fluctuation means that filling up your car at 6:00 am would have cost you about €1,035, when you could have done it for free at 12:00 pm.

It may sound unbelievable, but instances of wild price volatility are not an isolated occurrence – and negative prices are not rare, either. In fact, the country experienced 457 hours of negative pricing in 2024, a figure expected to grow in the future. This phenomenon is known as ‘renewable cannibalisation’ and, while it allows businesses to make the most of free energy from the grid, it also impacts their ability to export excess energy and make the most of their renewable investment.

Storage Solutions as the Key to Energy Resilience

So, what to do? The need for energy resilience and price stability triggers the demand for an essential piece of the energy transition puzzle: storage. Unsurprisingly, battery storage is developing rapidly in Germany, though not quite as fast as required.

The most recent revision of the Energiewirtschaftsgesetz (EnWG) introduced significant changes to energy storage, with the goal of enhancing grid stability. However, this mainly impacts front-of-the-meter operations, goes against the major European trend of energy decentralisation, and is not technology-agnostic.

On the other hand, the European Commission’s Affordable Energy Action Plan, released on 26th February 2025, states that:

“More flexibility in the system, for example with storage […] helps manage demand and supply imbalances by encouraging customers to shift electricity consumption to times when electricity is more plentiful or demand is lower, and therefore when electricity is cheaper. This reduces price spikes and negative price episodes, reducing […] volatility and contributing overall to lower and more stable electricity prices.”.

The translation? For businesses keen to save on energy bills, boosting their own flexibility with energy storage is the way forward. However, to do so, they will have to take matters into their own hands.

Flexibility with a pricing safety net

For German businesses, shifting consumption to low-cost periods and storing energy is key to saving money. But without tariff innovation, sudden price spikes can still pose a risk. Wattstor’s Price Protect solves this. It’s the only fully dynamic renewable tariff with a built-in price cap. It gives you the best of both worlds:

- Benefit from negative and low-price periods by charging batteries at minimal or zero cost.

- Avoid the impact of extreme peaks with a pre-agreed maximum price per kWh.

- Optimise your energy strategy by pairing Price Protect with onsite generation, battery storage, and Podium’s AI-driven optimisation.

This approach means German C&I businesses can participate fully in the benefits of a dynamic market without gambling their energy budget.

Fixed Tariff vs Fully Dynamic Tariff

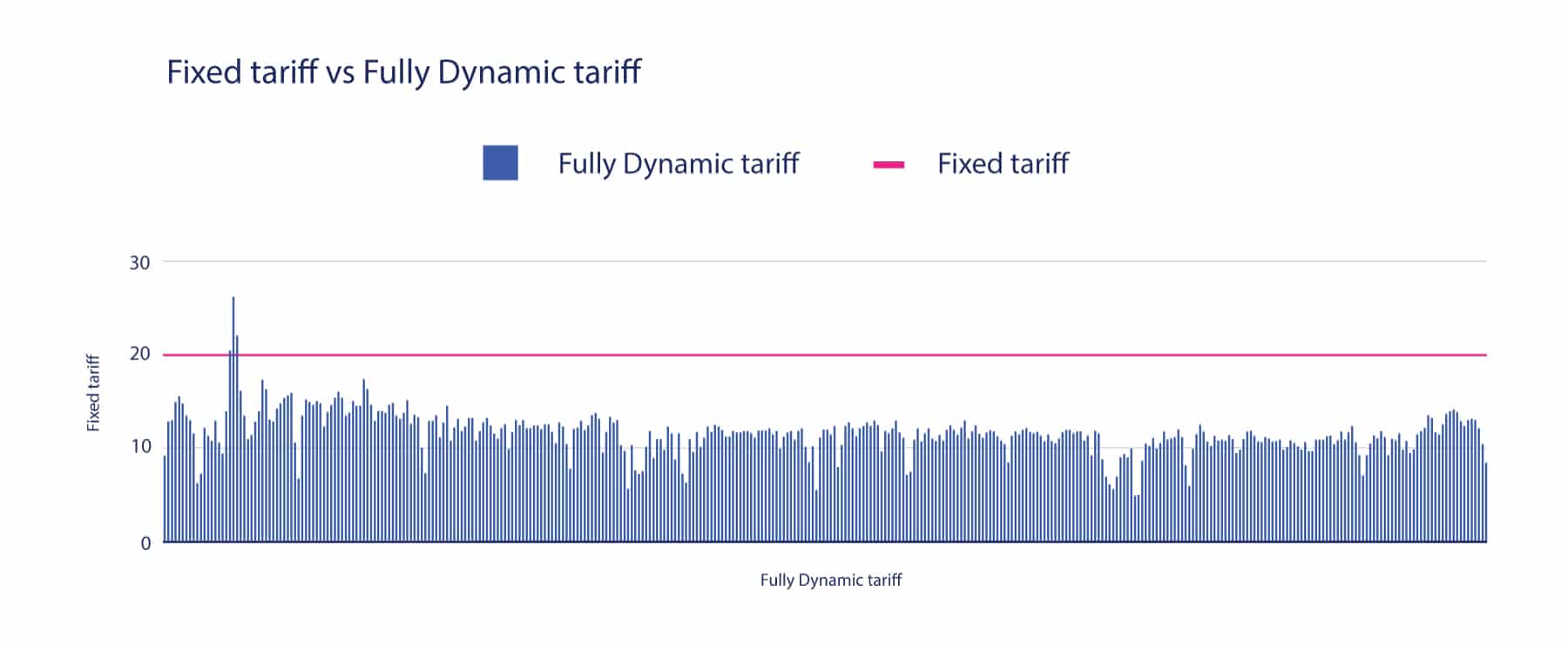

The graph below shows the dynamics of a fixed versus a fully dynamic tariff. It’s easy to see that, most of the time, businesses would be better off on a fully dynamic tariff, paying less when wholesale electricity prices drop.

However, there are instances where a sudden price spike means their bill would also suddenly rise. If instances of price spikes increase, businesses will have a problem. A fixed tariff can protect them from spikes, but doesn’t allow them to benefit from price drops.

The solution? Wattstor has recently launched Price Protect, the only fully dynamic renewable tariff on the market, with a price cap. With Price Protect, the manufacturer will get the best of both worlds: they will always pay less than the market price for their electricity, but never more than agreed.

In this example, a fixed tariff will protect the business in the one instance in which prices are spiking. However, they won’t be able to benefit from lower wholesale prices for most of the time.

With a fully dynamic tariff, the business will benefit in most cases. However, it won’t be protected from higher energy costs when wholesale prices spike. Price Protect offers the best of both worlds for German businesses. It provides protection from price spikes thanks to a price cap. At the same time, it allows businesses to benefit from price drops through the fully dynamic mechanism.

Turning price volatility into commercial opportunity

For German businesses, the question is no longer if electricity prices will fluctuate. The real question is how prepared they are to deal with it. By using onsite renewables, smart battery storage, and intelligent energy management, they can take control. Volatility then shifts from a cost risk to a cost-saving opportunity.

„It is our vision to empower every business and community to actively participate in the green energy transition and financially benefit from it.“

Stephan Marty, CEO at Wattstor

Wattstor is a next-generation energy company providing complete onsite renewable energy solutions. We believe clean, affordable energy is a business essential. We are committed to removing all obstacles to the clean energy transition.

Our fully funded energy systems help make net zero a reality for energy-intensive organisations in all sectors – with no upfront costs and guaranteed lower-than-grid electricity prices.

From industry-leading consultancy, to unique tariffs, state-of-the-art solar + BESS, and a powerful AI-based EMS, Wattstor is the one-stop specialist for organisations eager to fast forward their net zero ambitions.

Sales: [email protected]

Need help? Visit our Wattstor Customer Support Portal.

Know someone who'd be interested in this? Why not share it: